FreshBooks is a popular choice for small businesses. But, there are other great options out there. These alternatives offer more features, flexible prices, and better user experiences. Let’s look at some top FreshBooks alternatives for small businesses in 2024.

Key Takeaways

- FreshBooks has some downsides, like needing a live bank connection and missing inventory/COGS management.

- Looking at other options can give small businesses better accounting and invoicing tools.

- Top alternatives include QuickBooks Online, Zoho Books, Xero, AccountEdge, and Wave.

- When choosing accounting software, think about user experience, integration, and pricing.

- Open-source and customizable options offer extra flexibility for different business needs.

Why Consider FreshBooks Alternatives?

FreshBooks is a top pick for small businesses and freelancers. But, as needs grow, looking at other options can open new doors. You might find better billing apps, expense tracking, and time management tools.

Understanding FreshBooks Limitations

FreshBooks is great for invoicing and managing clients. Yet, it lacks in some areas. It’s not good for tracking inventory, class-based income, or adding many users without extra fees. These gaps can slow down growing businesses.

Benefits of Exploring Alternatives

Looking at FreshBooks alternatives can bring more features to your business. You might find tools that scale better, integrate more smoothly, and cost less. This can help streamline your finances and let you focus on what matters most.

| FreshBooks Alternatives | Key Features | Pricing |

|---|---|---|

| QuickBooks Online | Invoicing, payroll, expense tracking, tax preparation | $35-$200 per month |

| Xero | Payroll, workforce management, extensive integrations | $20-$80 per month |

| Wave Accounting | Free plan available, payment processing, reporting | Free plan, $15-$35 per month |

Exploring these options can help you find the perfect billing apps, expense tracking, and time management tools. This can boost your financial management and help your business grow.

Criteria for Evaluating Accounting Software

Choosing the right accounting software for your small business is important. It’s not just about the cost. Look at the user interface, how it integrates with other apps, and its pricing. Each factor is key to finding software that fits your business needs and helps it grow.

User Interface and User Experience

The design and ease of use of your accounting software matter a lot. A clean, easy-to-use design helps your team work better. It lets them quickly find what they need, making them more productive.

Integration Capabilities

Today, it’s crucial for your accounting software to work well with other apps. Look for software that integrates easily with other important tools. This makes your workflow smoother, improves data accuracy, and gives you a better view of your business.

Pricing Structures

Accounting software prices vary a lot. Some are cheap, while others are more expensive but offer more features. Think about the cost now and how it will grow with your business. Choose a plan that fits your needs now and in the future.

| Accounting Software | User Rating | Ideal for |

|---|---|---|

| QuickBooks Online | 4.5 Outstanding | Small businesses with a technology budget |

| Xero | 4.0 Excellent | Businesses needing powerful reporting tools and multiple user access |

| FreshBooks | 4.5 Outstanding | Service-based businesses with exceptional user experience |

| Sage 50 Accounting | 4.0 Excellent | Businesses needing robust inventory tracking and advanced accounting capabilities |

| Wave Accounting | 4.0 Excellent | Very small businesses with heavy invoicing needs and simple financial requirements |

| Zoho Books | 4.0 Excellent | Larger small businesses needing depth and flexibility in every module |

By looking at these key points, you can find the best accounting software for your small business. It will help you manage your finances better and make smart decisions for your business’s future.

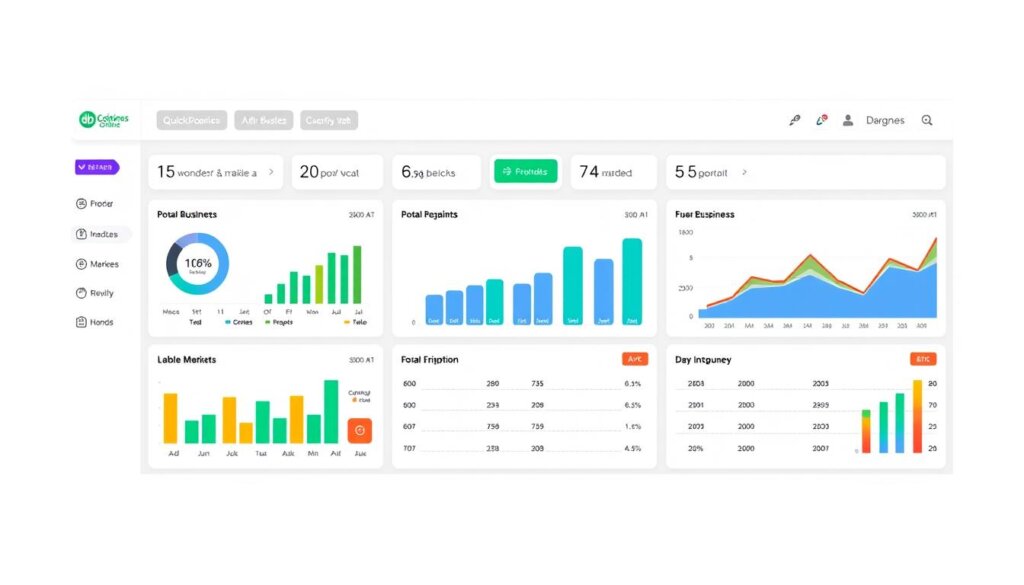

QuickBooks Online: A Leading Choice

QuickBooks Online is a top pick for small business accounting. It has many features and pricing plans for different needs. It’s great for invoicing, managing inventory, and handling payroll.

Key Features of QuickBooks Online

QuickBooks Online is easy to use. It has features like automatic sales tax, expense tracking, and real-time reports. It also works well with many third-party apps.

Pricing Plans for Different Needs

- QuickBooks Online has plans from $35 to $235 a month. They support 1 to 25 users.

- The more expensive plans have extra features. These include tracking inventory and project profits. You also get access to QuickBooks ProAdvisors.

- Businesses can pick a plan that matches their size and needs. This way, they only pay for what they use.

Pros and Cons of QuickBooks Online

| Pros | Cons |

|---|---|

| It has lots of features for small business accounting. | It costs more than some other options. |

| It works well with many third-party apps. | The lower plans don’t have time tracking. |

| You get access to QuickBooks ProAdvisors. | It might be hard for new users. |

QuickBooks Online is a strong choice for small business accounting. But, make sure it fits your business needs before choosing it.

Xero: A Comprehensive Solution

Xero is a top cloud-based accounting software. It has many features for small businesses. It helps teams work together well, making bookkeeping solutions and expense tracking easier.

Strong Features for Collaboration

Xero lets businesses have unlimited users on all plans. This makes it easy for teams to work on financial tasks together. It also works with Gusto for payroll, helping manage finances well.

Price Transparency with Xero

Xero’s prices are clear and simple. There are three plans: Early for $20 a month, Growing for $47, and Established for $80. Each plan has more features as businesses grow.

User Feedback and Experience

Users like Xero for its easy-to-use design and many features. But, some say it could be better for customizing for different industries. Still, Xero is great for small businesses because of its teamwork tools, clear prices, and user-friendly design.

Wave: Pricing Meets Performance

Wave is a top pick for free accounting software, especially for freelancers and startups. Its Starter plan is free and includes basic accounting and invoicing. This makes it easy for small businesses to manage their finances.

Ideal for Freelancers and Startups

Wave’s free plan is perfect for freelancers and small business owners. It offers tools like recurring invoices and expense scanning. It’s great for those who need a simple, affordable way to manage their finances.

Features That Stand Out

- Free Starter plan with core accounting and invoicing capabilities

- Paid Pro plan at $16 per month with unlimited users

- Automated bank and credit card connections for seamless transaction tracking

- Customizable invoices and estimates to present a professional brand image

- Integrated payment processing for hassle-free client payments

Limitations of Wave

Wave is great for its free plan, but it has some limits. It doesn’t have features like inventory tracking or project management. The free plan also lacks payment processing fee options and payroll controls.

| Feature | Wave Starter (Free) | Wave Pro ($16/month) |

|---|---|---|

| Accounting | ✓ | ✓ |

| Invoicing | ✓ | ✓ |

| Expense Tracking | ✓ | ✓ |

| Unlimited Users | – | ✓ |

| Inventory Management | – | – |

| Project Management | – | – |

“Wave’s free plan is a game-changer for freelancers and startups, providing essential accounting and invoicing tools without any monthly fees.”

Wave is a great choice for small businesses and freelancers. It offers a free plan with key features and a Pro plan for more. It’s all about affordability and ease of use.

Zoho Books: A Versatile Alternative

Businesses are looking for good billing apps and time management tools. Zoho Books is a great choice. It’s a cloud-based accounting platform for small and medium-sized businesses.

Tools for Automation and Efficiency

Zoho Books has many automation features. It makes tasks like invoicing and expense tracking easier. You can also manage your finances on the go with its mobile app.

The software works well with other Zoho apps. This makes it great for businesses that need a complete set of tools for automation and efficiency.

Cost-Effectiveness for Small Teams

Zoho Books is very affordable, especially for small teams. It has a free plan for businesses with less than $50,000 in annual revenue. This is perfect for startups and freelancers.

The paid plans start at $20 and go up to $275 a month. They meet the needs of growing companies. This makes it cost-effective for small teams.

Customer Support Insights

Zoho Books has great customer support. Users say it answers their questions quickly. This is very helpful for businesses dealing with financial management.

Zoho Books might not be as well-known in the US. But its flexibility, price, and focus on customers make it a good choice for small businesses looking for billing apps and time management tools.

Sage Business Cloud Accounting

Small and medium-sized businesses can use Sage Business Cloud Accounting to make their accounting easier. It’s a cloud-based platform made for growing companies. It has many tools for managing money and working with clients.

Tailored for Growing Businesses

Sage Business Cloud Accounting grows with your business. It has features for managing inventory and working with Microsoft 365 Business. This helps businesses stay in control and efficient as they get bigger.

Core Features to Support Clients

- Streamlined invoicing and billing processes

- Automated bank reconciliation and expense tracking

- Comprehensive reporting and analytics for informed decision-making

- Collaborative features for seamless team and client interactions

Pricing and Accessibility

Sage Business Cloud Accounting has flexible pricing for small project management platforms and small business accounting companies. But, it might not be the cheapest for simple accounting needs. It’s important to check if it fits your budget and needs.

| Feature | Sage Business Cloud Accounting | Bonsai | QuickBooks Online | FreshBooks | Xero |

|---|---|---|---|---|---|

| Invoicing and Billing | ✓ | ✓ | ✓ | ✓ | ✓ |

| Expense Tracking | ✓ | ✓ | ✓ | ✓ | ✓ |

| Reporting and Analytics | ✓ | ✓ | ✓ | ✓ | ✓ |

| Collaboration Tools | ✓ | ✓ | Limited | ✓ | ✓ |

| Pricing | $$$ | $$ | $$ | $$ | $$ |

Invoice Ninja: Free and Paid Plans

Freelancers and small businesses can find a great alternative to FreshBooks in Invoice Ninja. It offers many invoicing tools and finance apps. Invoice Ninja has both free and paid plans, making it easy to manage business tasks like invoicing and tracking expenses.

Overview of Invoice Ninja Features

The free plan of Invoice Ninja comes with four customizable invoice templates. The Ninja Pro and Enterprise plans offer more templates and no limits on invoices and quotes. It’s easy to use and has over 200,000 users who love it.

Comparison with FreshBooks Pricing

Invoice Ninja is cheaper than FreshBooks, especially for freelancers and startups. FreshBooks has three fixed plans and a custom option. Invoice Ninja has a free plan and tiered subscriptions, so businesses can find a plan that fits their budget.

User Reviews and Feedback

Invoice Ninja gets high ratings from its users, with a 5/5 score on many platforms. People love its easy-to-use interface, great features, and customer support. It’s one of the top free invoicing tools for self-employed finance apps.

“Invoice Ninja has been a game-changer for my freelance business. The free plan offers everything I need to manage my invoices and expenses, and the user reviews gave me the confidence to try it out. I’m so glad I did – it’s been a lifesaver!”

FreshBooks vs. Alternatives: A Feature Comparison

When looking at accounting software, it’s key to check the main features you need. FreshBooks alternatives might have special perks for your business. Let’s see how some top choices compare to FreshBooks in important areas.

Core Features: Billing and Invoicing

FreshBooks is good for basic invoicing and billing. But, QuickBooks Online and Xero have more advanced features. QuickBooks Online has great inventory management. Xero makes working with clients easy.

Wave is free and perfect for freelancers and small businesses. It’s a great choice for those on a tight budget.

Reporting Capabilities

Zoho Books is known for its easy-to-use reports and mobile access. Sage Business Cloud Accounting is great for growing businesses. It has detailed reports for managing money well.

Invoice Ninja has free and paid plans. It meets different reporting needs.

Customer Support Options

FreshBooks alternatives like QuickBooks Online and Xero have great customer support. Zoho Books and Sage Business Cloud Accounting also offer help. Good customer service is important when picking accounting software.

| Feature | FreshBooks | QuickBooks Online | Xero | Wave | Zoho Books |

|---|---|---|---|---|---|

| Billing and Invoicing | ✔ | ✔✔ | ✔✔ | ✔ | ✔✔ |

| Inventory Management | ✔ | ✔✔ | ✔ | ✔ | ✔✔ |

| Reporting | ✔ | ✔✔ | ✔✔ | ✔ | ✔✔✔ |

| Customer Support | ✔ | ✔✔✔ | ✔✔✔ | ✔✔ | ✔✔✔ |

When looking at accounting software, think about what your business needs. Find the best accounting software or bookkeeping solutions for your financial management and growth.

The Benefits of Open-Source Accounting Solutions

Open-source accounting software can change how you manage your small business’s money. These free tools offer many benefits over paid ones. Let’s look at why open-source is great for your free accounting software and small business accounting needs.

Popular Open-Source Options

GnuCash and LedgerSMB are two top open-source accounting tools. They have features like invoicing, tracking expenses, and financial reports. And the best part? They’re free for users.

Customization and Flexibility

Open-source accounting software stands out because you can customize it. Since the code is open, you can make it fit your business perfectly. You can also link it with other tools and systems.

Community Support and Development

These tools grow thanks to a big community. Users help each other through tutorials, forums, and more. This way, the software gets better and better over time.

Exploring open-source accounting can open doors for small businesses. Tools like GnuCash and LedgerSMB offer cost savings, customization, and community support. They help make your accounting easier and help your business grow.

Key Takeaways When Choosing an Alternative

When picking a new accounting tool for your small business, think about what you need now and in the future. Look at how it can grow with your business and what it costs. Check out user limits, how it handles inventory, and its reporting features to find the best fit.

Assessing Your Business Needs

First, figure out what you really need for accounting and bookkeeping. Think about how many users you’ll need, the complexity of your money dealings, and the reports you must have. This will show you what features are most important for your daily work.

Future Scalability Considerations

As your business gets bigger, your accounting needs will change. Choose a tool that can grow with you. It should let you add more users, handle more money, and offer better reports and analytics. This way, your accounting software will support your growing business.

Setting a Budget

Pricing for bookkeeping solutions varies a lot. FreshBooks starts at $19 a month, but QuickBooks Online costs between $35 and $235. Wave even offers a free plan with extra features for sale. Look at what each price gets you to find the best deal for your money.

| Accounting Software | Pricing |

|---|---|

| FreshBooks | $19 – $60 per month |

| QuickBooks Online | $35 – $235 per month |

| Wave | Free basic plan, additional features available |

| Xero | $13 per month and up |

| myBooks | $4.99 per month |

| Sage Accounting | $7.50 per month |

| Zoho Books | $15 per organization per month billed annually |

| ZipBooks | $15 per month |

| Quicken | $3.49 per month billed annually |

| FreeAgent | $10 per month for the first 6 months, $20 per month after |

| BigTime | $10 per user per month billed annually |

By thinking about your business needs, how it will grow, and your budget, you can pick the right accounting software for your small business.

Making the Transition Smooth

Switching to a new accounting software can seem hard. But, with the right steps, it can be easy for your business. Follow best practices, plan well, and train your team well.

Best Practices for Migrating Data

First, back up your current data when moving to a new platform like project management platforms or time management tools. This keeps your info safe. Services like MMC Convert help move data from FreshBooks to Zoho Books. They cover up to a year of history plus the current year, usually in 7-9 days.

Timeframe for Implementation

Choose a good time to start using the new software. Pick a quiet time to avoid problems. MMC Convert can handle big data, making the switch easy for all sizes.

Training Your Team

Teach your team well to make the switch smooth. Show them how to use new features like automated feeds and expense tracking. Zoho Books has strong security to keep your data safe during training.

Follow these tips, plan well, and train your team. This way, moving to new accounting software will be easy and efficient for your business.

- Data migration support

- Automated bank feeds

- Expense monitoring

- Robust security measures

- 30-day free trial

- Optional Gusto payroll add-on

- User-friendly interface

- Extensive integration capabilities

- Comprehensive accounting features

- Customizable reporting

- Mobile app for on-the-go access

- Inventory management tools

| Accounting Software | Pricing Plans | Key Features |

|---|---|---|

| Zoho Books |

|

|

| Xero |

|

|

| QuickBooks Online |

|

Think about these tips and look at project management platforms and time management tools. This way, you can smoothly switch to a new accounting software that fits your business.

Combining Tools: Using Accounting with Other Apps

In today’s digital world, linking your accounting software with other tools boosts efficiency and productivity. This integration streamlines workflows, automates tasks, and offers a full view of your finances.

Benefits of Integration with Third-Party Apps

Linking your accounting software with other apps brings many benefits. It connects your billing apps and expense tracking tools, making data flow smooth and cutting down on manual entry. This also helps with teamwork, quick reports, and better decision-making.

Must-Have Integrations for Enhanced Efficiency

- Payment Processors: Connect your accounting software with payment gateways like PayPal, Stripe, or Square. This automates invoicing and makes payments smoother.

- Customer Relationship Management (CRM) Systems: Link your accounting data with CRM platforms. This helps manage client info, track sales, and improve client service.

- Project Management Tools: Integrate your accounting software with project management solutions. This tracks billable hours, expenses, and project profits.

Top accounting platforms like QuickBooks Online and Xero offer many integration options. They let you connect with various business apps. Zoho Books also integrates well within the Zoho ecosystem, offering a full suite of tools for managing finances and operations.

When looking at accounting software, check its integration options. Choose the ones that best fit your business needs. Focus on integrations that make your workflows smoother and improve your financial management.

“Integrating your accounting software with other business tools can be a game-changer, unlocking new levels of efficiency and visibility for your financial operations.”

Conclusion: Finding the Right Fit for Your Business

FreshBooks is popular, but there are better choices for your small business. QuickBooks Online, Xero, Wave, Zoho Books, and Sage are great alternatives. They offer different features, prices, and growth options for various businesses.

Recap of Popular FreshBooks Alternatives

QuickBooks Online is known for its strong features and easy use. Xero has great teamwork tools. Wave is cheap but packed with features, perfect for freelancers and new businesses.

Zoho Books helps with automation, and Sage Intacct is good for growing businesses. Each has its own benefits, so choose wisely based on your needs.

Encouragement to Explore Various Options

Try out different FreshBooks alternatives and use free trials. This way, you can find the best accounting software for your business. Each option has its own strengths, so pick the one that fits your budget and growth plans.

Final Thoughts and Recommendations

When looking for a FreshBooks alternative, think about price, growth, integration, and user experience. By looking closely at these, you’ll find software that makes your finances easier. It will help your business grow and succeed in the long run.

FAQ

What are the limitations of FreshBooks?

What factors should I consider when evaluating accounting software alternatives?

What are the key features of QuickBooks Online?

How does Xero compare to FreshBooks?

What are the benefits of Wave accounting software?

How does Zoho Books compare to FreshBooks?

What are the benefits of using open-source accounting solutions?

What are the best practices for transitioning to a new accounting software?

How can integrating accounting software with other business tools enhance efficiency?

Thomas Steven is a 15 Years of experience digital marketing expert. He covers all things tech, with an obsession for unbiased news, reviews of tech products, and affiliate deals. With his experience, Thomas helps consumers choose what and how to buy from evaluating products by features, ease-of-use, cost-effectiveness or customer care allowing them to make intelligent purchasing decisions in the dynamic world of technology.