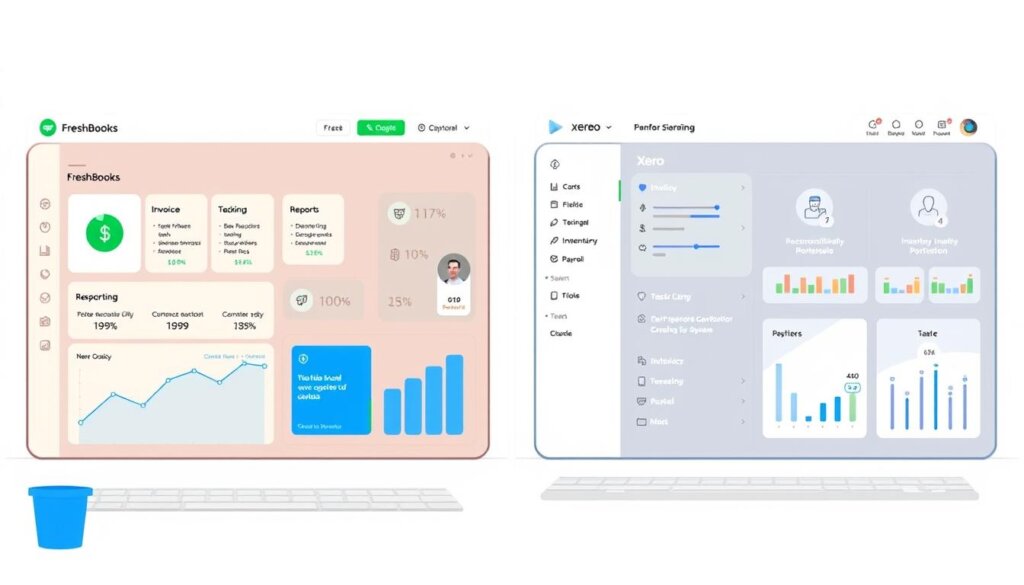

In the world of cloud-based accounting, two big names stand out: FreshBooks and Xero. They are leaders in the field. Each offers unique features, pricing, and user experiences for small businesses.

is key for small businesses looking for easy, flexible, and accessible financial tools. FreshBooks is great for freelancers and solo workers, with easy invoicing and time tracking. Xero, however, is a full-featured solution. It’s perfect for growing companies with its strong accounting and scalability.

Key Takeaways

- FreshBooks is best for freelancers and solo workers, with unlimited time tracking and invoicing.

- Xero is ideal for growing businesses, offering strong accounting, unlimited users, and inventory management.

- Both FreshBooks and Xero provide cloud-based solutions with mobile apps. But, they differ in pricing, features, and who they’re for.

- FreshBooks is easy to use and automates invoicing. Xero is great for tracking expenses, reporting, and handling multiple currencies.

- Businesses should think about their needs and choose the right accounting software. It should match their size, industry, and financial needs.

Introduction to FreshBooks and Xero

FreshBooks and Xero are top names in online accounting. They help small and medium-sized businesses manage their finances. Both offer features for entrepreneurs and accounting pros.

Brief Overview of FreshBooks

FreshBooks is easy to use, perfect for freelancers and small businesses. It makes invoicing, tracking expenses, and managing time simple. FreshBooks offers a free trial for all plans, making it easy to start.

Brief Overview of Xero

Xero helps businesses of all sizes, from startups to big companies. It has many features like bank reconciliation and inventory management. Xero also works with over 1,000 apps. It has a free trial, so you can try it before you buy.

| Feature | FreshBooks | Xero |

|---|---|---|

| Invoicing | Customizable invoices, late payment reminders, recurring invoices | Automated invoicing, invoice customization, online payments |

| Expense Tracking | Expense categorization, mileage tracking, receipt scanning | Expense categorization, receipt management, automatic bank reconciliation |

| Reporting | Profit and loss statements, expense reports, summary invoices | Comprehensive financial reports, budgeting, forecasting |

FreshBooks and Xero have strong features for businesses. They make managing finances easy. Think about what you need before choosing the best platform for your business.

Key Features Compared

When picking accounting software, look closely at what FreshBooks and Xero offer. These features can really help your business run smoother.

Invoicing Capabilities

FreshBooks is great for making invoices. It lets you create unlimited invoices and send payment reminders. Xero’s base plan only lets you make 20 invoices a month. Both are good, but FreshBooks is more flexible.

Expense Tracking

FreshBooks and Xero both track expenses well. But FreshBooks has a cool feature: you can scan receipts on your phone. Xero tracks expenses too, but it’s not as easy to use on the go.

Reporting and Analytics

Xero has more advanced reporting tools. It gives you deeper insights into your business and taxes. FreshBooks is simpler, focusing on basic reports for freelancers and small businesses.

| Feature | FreshBooks | Xero |

|---|---|---|

| Invoicing | Unlimited customizable invoices, payment reminders, and proposals | 20 invoices per month on the base plan |

| Expense Tracking | Includes mobile receipt scanning | Comprehensive expense tracking |

| Reporting and Analytics | Focuses on basic business health and tax reports | Offers more advanced reporting and analytics tools |

Both FreshBooks and Xero have great features for small businesses and freelancers. Your choice depends on what matters most to your business, like invoicing, tracking expenses, or detailed reports.

User Interface and Experience

Both FreshBooks and Xero have different ways to help small businesses and freelancers. They focus on making accounting easy and user-friendly.

FreshBooks’ User-Friendly Design

FreshBooks is known for its easy-to-use interface. It’s perfect for those who aren’t accountants. Its layout is simple and easy to navigate, getting a 4 out of 5 for user-friendliness.

FreshBooks also offers detailed guides and tips. This makes it easy for new users to start using the software.

Xero’s Navigation and Layout

Xero’s accounting app interface is designed for those who want more control. It has a customizable dashboard and a global search. This makes it easier to find what you need.

Even though Xero might be a bit harder to learn, it’s still easy to use. It gets a 4 out of 5 for user-friendliness. It also has advanced features for all business sizes.

Mobile App Usability

- FreshBooks lets you create invoices and track expenses on your phone.

- Xero’s app has features like bank reconciliation and expense management.

Both FreshBooks and Xero have great mobile apps. They let you access important accounting tools anytime, anywhere.

| Feature | FreshBooks | Xero |

|---|---|---|

| User-Friendliness Rating | 5 out of 5 | 4 out of 5 |

| Interface Design | Clean and straightforward | Customizable dashboard with global search |

| Mobile App Capabilities | Invoicing, expense tracking, mileage tracking | Bank reconciliation, expense management, financial reporting |

“FreshBooks’ user-friendly interface and comprehensive mobile app features make it an excellent choice for small businesses and freelancers who prioritize ease of use and on-the-go functionality.”

Pricing Structures

Accounting software costs can be a big deal for businesses. FreshBooks and Xero have prices that fit many budgets and needs.

FreshBooks Pricing Tiers

FreshBooks has four plans with prices from $142.80 to custom. The Lite plan is $142.80 a year. It includes unlimited invoicing and expense tracking.

The Plus plan costs $252.00 a year. It adds mobile mileage tracking and recurring bills. The Premium plan is $462.00 a year. It includes accounts payable and automatic late payment reminders.

For more complex needs, FreshBooks Select has custom pricing. It offers migration support and lower credit card fees.

Xero Pricing Options

Xero has three plans starting at $13 a month for the Early plan. The Growing plan is $37 a month. It adds bulk transaction reconciliation and short-term cash flow.

The Established plan is $70 a month. It includes project tracking and expense claiming. It also supports multi-currency.

Which Offers Better Value?

Both FreshBooks and Xero are cheaper than QuickBooks. FreshBooks might be better for freelancers and small teams. Xero’s plans are good for bigger businesses.

“FreshBooks and Xero offer competitive pricing compared to more popular accounting software like QuickBooks.”

Integrations and Add-Ons

Accounting software needs to work well with other apps. FreshBooks and Xero both have lots of integrations. This lets users make a solution that fits their needs.

Popular Integrations for FreshBooks

FreshBooks has over 100 app integrations. It works with WePay, Stripe, and PayPal for easier invoicing and payments. It also connects with project management tools, CRM software, and e-commerce sites. This makes FreshBooks great for accounting software integrations in the business app ecosystem.

Popular Integrations for Xero

Xero has over 1,000 app connections. It works with Shopify for e-commerce and Hubdoc for document management. Xero’s wide range of accounting software integrations helps businesses create a full business app ecosystem that meets their needs.

| FreshBooks Integrations | Xero Integrations |

|---|---|

|

|

“The extensive integration options provided by Xero allow us to streamline our business operations and create a tailored solution that meets all our needs.”

Both FreshBooks and Xero have many accounting software integrations. They help businesses with invoicing, payments, project management, and e-commerce. The best choice depends on what you need and how deep you want your integration to be in the business app ecosystem.

Customer Support Services

Good customer support is key for businesses using accounting software. FreshBooks and Xero have different ways of helping their users. Each has its own good points and areas for improvement.

FreshBooks Support Channels

FreshBooks focuses on helping its users. You can call or email them from 9 a.m. to 5 p.m. ET. They also have a chatbot for quick help.

They have a big help center with lots of tutorials and guides. This shows their dedication to accounting software support and customer service quality.

FreshBooks is very good at this, with a 91% customer satisfaction rate. Their team, over 100 strong, has a 4.8/5.0 star rating from over 120,000 reviews.

Xero Support and Resources

Xero focuses on online support. They have a 24/7 online hub with lots of resources. But, they don’t offer phone support, which might not be what some businesses want.

Even though Xero’s online help is vast, some users find their response times slow. This can be a problem for those needing quick help with customer service quality.

File Management and Storage

In today’s world, managing files is key for businesses. FreshBooks and Xero help with this. They offer great ways to store documents, bills, contracts, and receipts.

Document Management in FreshBooks

FreshBooks makes it easy to handle files in its project management. You can upload, store, and share project and invoice documents. But, FreshBooks doesn’t have as much storage as Xero.

Document Management in Xero

Xero is top-notch for file management and storage. It has a cloud-based system. This lets users manage and access documents from anywhere, making accounting easier.

Both FreshBooks and Xero keep your files safe and sound. But, Xero’s cloud storage and accounting integration are better for businesses. It’s great for a central document system.

“Xero’s cloud-based document management system has been a game-changer for our accounting team, allowing us to access and collaborate on important files from anywhere, anytime.”

Security Features

In today’s digital world, keeping data safe is crucial. FreshBooks and Xero know this well. They use strong security to protect their clients’ financial info.

FreshBooks’ Security Measures

FreshBooks focuses on keeping your data safe with several key steps:

- Encryption: They use top encryption to keep data safe while it’s moving and when it’s stopped.

- Backups: They back up your data often. This helps keep your business running smoothly, even in tough times.

- Multi-Factor Authentication: You need to prove who you are in more than one way. This makes it harder for others to get in.

Xero’s Data Protection Strategies

Xero has a big plan to keep your data safe. Here’s what they do:

- SOC 2 Compliance: Xero follows the strict SOC 2 security rules. This means experts check their security often.

- Encryption and Backups: They use strong encryption and keep backups to protect your data.

- Third-Party Audits: Xero lets independent security teams check their security. This shows they’re serious about keeping data safe.

FreshBooks and Xero really care about keeping your data safe. They make sure you can handle your money without worry.

Target Audience and Business Size

Choosing the right accounting software depends on your target audience and business size. FreshBooks and Xero cater to different types of businesses.

Freelancers and Small Businesses

FreshBooks is great for freelancers, self-employed, and small businesses. It’s easy to use for invoicing, tracking expenses, and basic reports. It starts at $15 a month, perfect for those on a budget.

Medium to Large Enterprises

Xero is best for larger small businesses and medium-sized enterprises. It supports growth with unlimited users and advanced reports. Xero starts at $11 a month, fitting various business sizes.

| Feature | FreshBooks | Xero |

|---|---|---|

| Pricing Range | $15 – $50 per month | $11 – $60 per month |

| Target Audience | Freelancers, self-employed, small businesses | Larger small businesses, medium-sized enterprises |

| Scalability | Limited to a few employees | Unlimited users and more advanced features |

Choosing between FreshBooks and Xero depends on your business needs. Both offer strong accounting solutions. But, the complexity and scalability needed will decide the best choice for you.

Customization Options

FreshBooks and Xero both have customization features for businesses. But, they differ in how much you can customize.

Customizing FreshBooks

FreshBooks lets you change invoices, estimates, and proposals. You can add your logo, change colors, and include your own messages. It also has custom fields for client or project info.

Customizing Xero

Xero has more customization options than FreshBooks. You can make your dashboard your own, focusing on what’s important to you. It also lets you create personalized accounting software and custom financial reports for your needs.

Xero also lets you make your own tracking categories. This helps with detailed financial analysis.

| Customization Feature | FreshBooks | Xero |

|---|---|---|

| Invoice Customization | ✓ | ✓ |

| Custom Dashboard | – | ✓ |

| Custom Report Templates | – | ✓ |

| Personalized Tracking Categories | – | ✓ |

In summary, Xero offers more customization than FreshBooks. This means businesses can tailor their accounting software more to their needs.

Performance and Reliability

Accounting software must perform well and be reliable for businesses. FreshBooks and Xero are cloud-based, offering high uptime and easy access from anywhere. Yet, they differ in how open they are and what users say about them.

Speed and Uptime for FreshBooks

FreshBooks users say it’s fast, especially for invoicing and tracking expenses. It’s quick and efficient, making it easy for small businesses and freelancers to handle their money. FreshBooks focuses on being easy to use, with speed and reliability at the top of its list.

Speed and Uptime for Xero

Xero is open about its system status and performance. It has a great uptime record, so users can count on it being available. Xero is known for being reliable, with quick fixes for any problems.

Choosing the right accounting software means looking at performance and reliability. FreshBooks and Xero are both good, but how open they are and what users say might influence your choice.

“The speed and uptime of my accounting software are crucial for maintaining the efficiency of my business operations. FreshBooks has consistently delivered on this front, allowing me to focus on serving my clients without worrying about technical issues.”

– Jane Doe, Small Business Owner

User Reviews and Testimonials

Choosing the right accounting software can be tough. User reviews and testimonials help a lot. Both FreshBooks and Xero are favorites among small businesses and freelancers. Users love their unique features and capabilities.

Insights from FreshBooks Users

FreshBooks users love how easy it is to use. They also praise its strong invoicing features. Sarah says, “I love how FreshBooks makes it easy to create professional-looking invoices and keep track of my expenses. The mobile app is a lifesaver when I’m on the go.”

But, some users say FreshBooks has limits as their business grows. Emily notes, “While FreshBooks worked great when I was a freelancer, I found that it lacked some of the more robust reporting and integration options I needed as my business expanded.”

Insights from Xero Users

Xero users love its wide range of features and how it grows with their business. They like its multi-currency support, inventory management, and advanced financial reporting. Michael says, “Xero has been a game-changer for my small business. The seamless bank connections and detailed reporting have saved me a lot of time and headaches.”

But, some users are worried about Xero’s customer support and price hikes. Sarah mentions, “While Xero’s features are impressive, I’ve had a few issues with their customer support responsiveness and the recent price hike for my plan.”

“FreshBooks makes it easy to create professional-looking invoices and keep track of my expenses. The mobile app is a lifesaver when I’m on the go.”

– Sarah, FreshBooks user

“Xero has been a game-changer for my small business. The seamless bank connections and detailed reporting have saved me a lot of time and headaches.”

– Michael, Xero user

Pros and Cons Summary

FreshBooks and Xero are top choices for accounting software. They have features for businesses of all sizes. Let’s look at what each offers.

Advantages of Using FreshBooks

- It’s easy to use, perfect for freelancers and small businesses.

- It has great invoicing tools, making invoices look professional.

- It’s good for tracking expenses and mileage.

- You can try it for free for 30 days.

Advantages of Using Xero

- Xero grows with your business, offering many features.

- It’s great for big teams because it has unlimited users.

- It connects with over 1,000 apps, making it versatile.

- It’s easy to navigate, even for accountants and small business owners.

Choosing between FreshBooks and Xero depends on your business needs. Think about your business size and budget. This will help you decide which accounting software is best for you.

Conclusion: Making the Right Choice

Both FreshBooks and Xero are great for managing your finances. They each have special strengths. Your choice depends on what your business needs and likes.

Key Takeaways from the Comparison

FreshBooks is perfect for freelancers and small businesses. It’s easy to use and great for sending invoices. It also has features like reminders for late payments and tools for creating estimates and attaching receipts.

Xero is better for growing businesses. It has advanced features like managing your bank accounts, inventory, and handling money in different currencies. It’s ideal for small to medium-sized businesses that need powerful financial tools.

Recommendations Based on Needs

If you mainly need to send invoices and track expenses, FreshBooks is a good pick. But, if you need more advanced features like managing inventory and payroll, Xero is better.

When picking between accounting software like FreshBooks and Xero, think about your business size and growth plans. Also, consider the features you need for managing your financial management tools. Both offer free trials, so you can try them out and see which one works best for you.

FAQ

How do FreshBooks and Xero differ in their invoicing capabilities?

What are the key differences in reporting and analytics between FreshBooks and Xero?

How do the user interfaces and mobile app experiences compare between FreshBooks and Xero?

What are the pricing structures for FreshBooks and Xero?

How do the integration capabilities of FreshBooks and Xero compare?

What are the differences in customer support between FreshBooks and Xero?

How do FreshBooks and Xero compare in terms of file management and storage?

What are the key differences in security features between FreshBooks and Xero?

Which accounting software is better suited for different business sizes and needs?

How do the customization options differ between FreshBooks and Xero?

Thomas Steven is a 15 Years of experience digital marketing expert. He covers all things tech, with an obsession for unbiased news, reviews of tech products, and affiliate deals. With his experience, Thomas helps consumers choose what and how to buy from evaluating products by features, ease-of-use, cost-effectiveness or customer care allowing them to make intelligent purchasing decisions in the dynamic world of technology.